First Home Buyers

First Home Buyers Guide

Buying your first home can be daunting. At GreenSpace Finance we hold your hand throughout the whole process. We treat our clients like one of our family was buying their first home.

Our goal is that you leave the finance meeting BUY READY

Our team is also an expert in current Government schemes that First Home buyers can be eligible for.

“It is never too early to buy a house. Every 5 years is a good year to invest in property”

Tips For First Home Buyers

Are you a first-time home buyer looking for the perfect place to call your own?

At GreenSpace Finance, we understand the excitement and challenges that come with purchasing your first home and want to provide you with valuable information and resources.

In this article, we will cover topics such as the Queensland First Home Buyers Grant, stamp duty concessions, government schemes, using gifted funds for the deposit, and family guarantees.

Our article also emphasises the expertise and support offered by GreenSpace Finance in helping first-time homebuyers navigate the mortgage process. We are here to guide you through the process and help you make informed decisions every step of the way.

- Plan for the Future: Keep in mind that your first home may not be your forever home. Consider living in it for at least three years, then you can choose to rent it out and purchase again or practice rent vesting.

- Stay Connected in a Strong Market: In a competitive real estate market, it’s a smart move to maintain a list on your phone with details like the agent’s name, the type of property you’re seeking, your approximate budget, and desired areas. This allows you to stay in contact with agents and stay top-of-mind.

- Engage with Agents: Reach out to agents, even for properties that are currently under offer. You want to be first in line if a deal falls through due to financing issues.

- Secure Pre-Approval: Obtain a pre-approval from a lender. Having pre-approval in hand empowers you to make strong offers with favourable terms, which can be a game-changer in a competitive market.

- Invest in Property: Keep in mind that many people build their wealth through property investments rather than traditional employment or business ventures.

- Long-Term Perspective: Understand that property is a long-term investment. Patience and holding onto your property can yield substantial returns over time.

Step-by-Step Guide to Making an Offer in QLD:

-

1. Determine Your Maximum Purchase Price:

-

2. Secure Pre-Approval:

Once you’re Buy Ready, our team can assist in obtaining a pre-approval, which enhances your purchasing power.

-

3. Property Search:

Start your property hunt, exploring listings that align with your budget and preferences.

-

4. Sign a Contract:

When you find the ideal property, sign a contract to express your intent to purchase.

-

5. Finance Approval:

After signing the contract, secure finance approval to ensure you can proceed with the purchase.

-

6. Settlement:

Coordinate the settlement process, ensuring all legal and financial requirements are met.

-

7. Move In:

Finally, upon successful settlement, you can move into your new home and start the next exciting chapter of your life.

Get Your Free Copy of Our First Home Buyers Guide

From how to figure out your deposit amount to making an offer. Will Burke shares the best tips for how to make an offer in this free guide.

Ways to get into your first home sooner than you think!

As a first-time homebuyer, you have the exciting opportunity to utilise gifted funds for your property deposit. This option can be a game-changer, propelling you closer to your dream of becoming a homeowner.

Gifted funds can cover either the entire deposit amount or a portion of it, allowing you to step into property ownership sooner than expected.

In some cases, lenders may require a ‘gift letter’ confirming that the funds have been given unconditionally and without any expectation of repayment. Even when using a gifted deposit, lenders still appreciate your financial discipline in managing home loan repayments.

To demonstrate this, you might be asked to provide evidence of genuine savings, which can include your rental payment history.

This approach not only accelerates your path to homeownership but also demonstrates your commitment to responsible financial management.

Speak to GreenSpace Finance now, to find out more. Contact GreenSpace Finance

Family Guarantees – Get the Support You Need

As a first-home buyer, amassing a deposit can be quite challenging. However, with the assistance of your family, you might realise your dream of owning your first home much sooner than anticipated. This is where the Family Guarantee comes into play. Through a Family Guarantee, a family member can use their property as collateral for your home loan.

This arrangement can effectively reduce your Loan Value Ratio (LVR) to below 80%, allowing you to circumvent the need for a Lender’s Mortgage Insurance (LMI) in addition to your deposit.

Your family member has the flexibility to choose either cash, such as savings or term deposit funds, or equity from their own home as collateral. Importantly, they won’t need to provide any funds directly to you, the borrower.

In essence, instead of having to save up a significant deposit, we can harness the equity from your family’s property to cover your contribution towards your new home. This can be a game-changer in expediting your journey to homeownership.

To learn more about family guarantees and how they can help you, join our VIP Newsletter to receive up-to-date information and industry news. Sign me Up!

GreenSpace Finance specialises in helping first-time homebuyers like you find the right mortgage solutions. Our team of experienced brokers is ready to provide advice and guide you through the entire process.

To learn more about family guarantees and how they can help you, join our VIP Newsletter to receive up-to-date information and industry news. Sign me Up!

Contact one of our brokers today for a free consultation and take the first step towards owning your dream home. Contact GreenSpace Finance

Conveyancer

When entering into a contract of sale, it’s essential to designate a conveyancer in the contract. Your chosen conveyancer will play a pivotal role in assisting you throughout the property purchase process, ensuring that you understand the legal aspects, coordinating funds at settlement, and overseeing the property’s transfer into your name.

To make an informed decision, we recommend researching potential conveyancers and posing these key questions as early in the process as possible:

- Specify your location, the type of property you’re interested in, and your current stage in the buying process.

- Inquire about their fee structure and costs.

- Ask about the types of property searches they conduct.

- Determine whether they review the contract before or after it’s signed.

- Request a breakdown of the funds required for your property purchase, as your GreenSpace Mortgage Broker will also provide these details.”

Building and pest

In Australia, the building and pest inspection process is a crucial step in the home-buying journey. This indispensable procedure involves a thorough evaluation of a property by certified professionals to identify any structural issues, damages, or pest infestations.

The main objective of this inspection is to provide potential homebuyers with a clear understanding of any potential problems before finalizing the purchase.

If you make an offer ‘subject to building and pest,’ you’ll typically have a specific number of days to complete a building and pest inspection.

To make the most of this process, consider asking the following questions:

- What type of property are you purchasing and where is it located?

- What is the cost of the inspection report?

- Can you be present during the inspection?

- How long does it take to receive the inspection report?

- Is it possible to discuss the findings over the phone?

- When is the earliest booking date available?

For instance, if the building and pest company requires a 10-day lead time for bookings, but your contract only allows for a 7-day window for building and pest inspections, it’s essential to ensure a feasible timeline with the chosen company.

What does a buyer’s agent do?

In Australia, a buyer’s agent is a professional dedicated to representing the interests of property buyers throughout the real estate purchase process.

Buyer’s agents typically charge a fee for their services, which can be structured as a flat fee, a percentage of the property’s purchase price, or a combination of both. Their primary objective is to ensure that buyers secure a property that matches their preferences and financial situation, all while navigating the complexities of the real estate market.

Wondering when is the right time to consult with us? The answer is anytime! You don’t need to wait until you’ve saved up your entire deposit. As brokers, our goal is to get you in a position to become ‘BUY READY’ at your convenience.

The team you need by your side:

At GreenSpace, we’re dedicated to getting you BUY READY! Our consultations go beyond simply telling you how much you can borrow.

We guide you through the entire process of making an offer and provide in-depth insights into purchasing your first home. Our goal is to ensure that after our meeting, you’re well-prepared and equipped to make your first home purchase confident

At GreenSpace Finance, we specialise in helping first-time homebuyers like you find the right mortgage solutions. Our team of experienced brokers is ready to provide advice and guide you through the entire process.

Contact one of our brokers today for a free consultation and take the first step towards owning your dream home.

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered professional advice. GreenSpace Finance is not responsible for any errors or omissions.

Lenders Mortgage Insurance

When securing a home loan for more than 80% of your property’s value, you may encounter a fee known as Lenders Mortgage Insurance (LMI). LMI is a one-time, non-refundable premium that safeguards the lending institution from potential losses if you’re unable to meet your loan obligations.

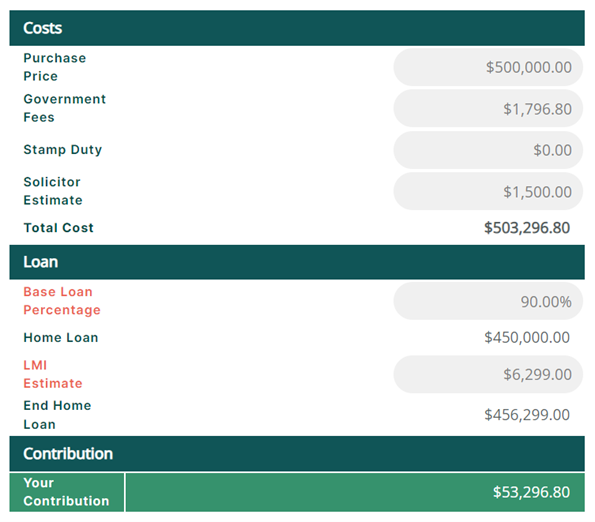

The LMI premium you pay can be significantly reduced by making a substantial initial deposit when purchasing your home. For instance, if you acquire a $500,000 home and provide a $100,000 deposit (equivalent to 20% of the property’s value), you can avoid LMI altogether. However, with a smaller deposit, say $40,000, Lenders Mortgage Insurance may become an option.

The exact amount of LMI varies based on several factors. To determine the specific cost and understand how LMI works in your particular situation, it’s advisable to contact us for personalised guidance.

Tip: Waiting to save up a 20% deposit might mean your property’s value increases more than the cost of Lenders Mortgage Insurance (LMI). Sometimes, it’s more advantageous to include LMI in your loan

Funds Tables:

First Home Guarantee and Family Home Guarantee Property Price Cap Table

|

“DID YOU KNOW? – YOU CAN USE MULTIPLE GOVERNMENT SCHEMES AT THE SAME TIME? CONTACT US TO FIND OUT HOW.”

Queensland First Home Buyers Grant – Get $15k Towards Your Dream Home

As a first homebuyer in Queensland, you may be eligible for the Queensland First Home Buyers Grant. This grant provides a $15,000 boost towards purchasing your first home, the home must be brand new.

To learn more about the eligibility criteria and how to apply, visit the Queensland Revenue Office website.

Stamp Duty Concessions – Save on Your Home Purchase

When buying a home, one of the significant costs to consider is stamp duty. Fortunately, Queensland offers stamp duty concessions to eligible first homebuyers. In Queensland, if you purchase an existing property worth $500K or less or Land worth $250K or less, there is no stamp duty. These concessions can help you save a substantial amount of money. To find out more about the stamp duty concessions.

Visit this link to learn more QLD.gov.au

Unlocking Your First Home with the First Home Super Saver Scheme

The First Home Super Saver (FHSS) scheme offers you a unique opportunity to save money for your first home using your super fund.

Under this scheme, you can make both before-tax concessional and after-tax non-concessional voluntary contributions into your super fund to build your first home nest egg. If you meet the eligibility criteria, you have the option to release these contributions, including their associated earnings, up to a specified limit to aid in purchasing your first home.

You can apply to include a maximum of $15,000 from your voluntary contributions in any given financial year as part of your eligible contributions eligible for release through the FHSS scheme. The total limit across all years is $50,000. (Note: If you made a release request before July 1, 2022, when the limit was $30,000, you cannot make further requests to reach the current $50,000 limit.)

Eligibility Requirements for the FHSS Scheme:

To utilise this scheme, you must meet the following criteria:

- Age Requirement: You should be 18 years or older when applying for an FHSS determination or requesting a release of funds under the FHSS scheme. However, you can make eligible contributions before turning 18.

- First Home Buyer Status: You must qualify as a first home buyer, which means you’ve never owned any property in Australia. This includes various property types such as investment property, vacant land, commercial property, land leases, or company title interests in land unless deemed a result of financial hardship.

- Intent to Occupy: Your intention should be to occupy the property you purchase as soon as practically possible and for a minimum of 6 months within the initial 12 months of ownership, once it’s feasible to move in.

- No Previous FHSS Request: You should not have previously made a request for an FHSS release.

- Residency Status: You are not required to be an Australian citizen or an Australian resident for tax purposes to utilize the FHSS scheme.

Eligibility is determined on an individual basis, allowing couples, siblings, or friends to access their own eligible FHSS contributions for the same property purchase. If any of the applicants have previously owned a home, it won’t affect the eligibility of others who meet the criteria.

Current Government First Home Buyers Guarantee- Make Your Dream Home a Reality

The Australian Government provides support to first-home buyers through various schemes and initiatives. One such scheme is the First Home Guarantee, which aims to make homeownership more accessible. This Scheme allows eligible first-home buyers to purchase a home with as little as a 5% deposit without paying the Lender’s Mortgage Insurance, (LMI).

Eligibility Requirements:

- Age Requirement: You must be at least 18 years old.

- Residency Status: You should be an Australian citizen or permanent resident at the time of loan application.

- Income Limits: Your individual or combined annual income should not exceed $125,000 for individuals or $200,000 for couples, as verified by your Notice of Assessment from the Australian Taxation Office.

- Owner-Occupier Intent: Your intention should be to reside in the purchased property.

- Price Cap in QLD: The property’s price must not exceed the $700,000 cap in Queensland.

- Joint Applications: Starting in July 2023, joint applications from friends, siblings, and family members will be accepted.

- Previous Home Ownership: Effective July 2023, previous homeowners may still qualify if their last ownership was at least 10 years ago.

Through the Home Guarantee Scheme (HGS), homebuyers have the opportunity to purchase various types of residential properties, which include:

- Existing houses, townhouses, or apartments.

- House and land packages.

- Land with a separate contract for home construction.

- Off-the-plan apartments or townhouses.”

To learn more about the current government scheme and how it can benefit you, visit this link https://www.nhfic.gov.au/support-buy-home/first-home-guarantee

Eligible Single Parent and Eligible Single Legal Guardian:

To be eligible for the FHG as a single parent or single legal guardian, you must meet the following criteria:

- Marital Status: You should be single, meaning you don’t have a spouse or de facto partner. (Note: Separated individuals who are not divorced are not considered single.)

- Dependent Requirement: You must have at least one dependent, which can be a dependent child as defined in the Social Security Act 1991 or a person receiving a disability support pension under the same Act and living with you.

- Legal Responsibility: You should demonstrate that you are legally responsible, either individually or jointly with another person, for the day-to-day care, welfare, and development of the dependent, who is under your care.

Eligible Property Types and Price Caps under the HGS:

Under the Home Guarantee Scheme (HGS), prospective homebuyers have the opportunity to purchase various residential property types, which include:

- Existing houses, townhouses, or apartments.

- House and land packages.

- Vacant land with a separate contract for constructing a home.

- Off-the-plan apartments or townhouses.

These options provide flexibility for homebuyers to find the property that suits their needs and preferences.

Get Your Free Copy of Our First Home Buyers Guide

From how to figure out your deposit amount to making an offer. Will Burke shares the best tips for how to make an offer in this free guide.